How To Enroll in ACA Insurance During Open Enrollment | Complete Guide

Enrolling in health insurance through the Affordable Care Act (ACA) is a critical step in securing affordable coverage for yourself or your family. As of 2024, a record 21.3 million people have selected an ACA Marketplace plan, reflecting the program’s growing importance in providing accessible healthcare options. With the 2025 Open Enrollment Period approaching, it’s essential to understand the enrollment process to ensure you obtain the coverage that best fits your needs.

This article provides a detailed guide on how to enroll in ACA insurance during open enrollment, covering eligibility, important dates, and the step-by-step process to ensure you get the coverage you need.

Read More: How The Affordable Care Act (ACA) Impacts On Small Businesses & Owners

Key Takeaways:

- Check Eligibility Before Open Enrollment: ACA plans are available to U.S. citizens and legal residents who do not have access to affordable employer-based insurance, Medicare, or Medicaid.

- Enroll During Open Enrollment: The Open Enrollment Period typically runs from November 1 to January 15, though life events can qualify you for a Special Enrollment Period.

- Create an Account on Healthcare.gov: To get started, create an account on the ACA marketplace or your state’s marketplace to explore available plans.

- Compare Plans Carefully: Consider premiums, deductibles, and out-of-pocket costs when choosing between Bronze, Silver, Gold, or Platinum plans.

- Apply for Subsidies: Premium tax credits and cost-sharing reductions can make ACA plans more affordable for individuals and families with qualifying incomes.

- Complete Enrollment and Pay: Finalize your plan selection by paying your first premium to activate coverage.

Table of Contents

What Is ACA Open Enrollment?

The ACA (Affordable Care Act) open enrollment period is a specific timeframe during which individuals and families can register themselves in health insurance plans that are offered through the Marketplace or exchange. The Marketplace is a term that is commonly used within various healthcare sectors, and it is a platform that offers an all-inclusive system of health coverage.

This system provides coverage for a wide range of medical services including preventive care, and emergency services, and the main objective of this system is to ensure that the general public, regardless of their financial status, can access quality healthcare services at affordable rates. The open enrollment period typically occurs annually and lasts for a few weeks, during which eligible individuals can sign up for coverage, make changes, or renew their existing health plans.

How To Enroll in ACA Insurance During Open Enrollment? Step By Step Guide

Step 1: Determine Your Eligibility:

Before enrolling in an ACA health plan, it’s important to check whether you qualify. Generally, ACA insurance is available to U.S. citizens and legal residents who do not have access to affordable employer-based insurance, Medicare, or Medicaid. You may also qualify if:

- You are self-employed or a freelancer.

- You are unemployed or your employer does not offer health insurance.

- Your household income falls between 100% and 400% of the federal poverty level (FPL) for premium tax credits.

- In states that have expanded Medicaid, you may qualify for Medicaid with an income up to 138% of the FPL.

If you are eligible for employer-provided insurance, Medicaid, or Medicare, you may not qualify for ACA subsidies.

Step 2: Dates For Open Enrollment For Health Insurance:

The ACA offers a specific time each year known as the Open Enrollment Period (OEP) when you can sign up for or change your health insurance plan. The OEP typically runs from November 1 to January 15, though these dates can vary slightly by state. During this period, you can:

- Enroll in a new plan.

- Renew your current plan.

- Switch to a different plan if your needs have changed.

If you miss the OEP, you may still be able to enroll in ACA insurance if you qualify for a Special Enrollment Period (SEP) due to certain life events, such as:

- Loss of employer-sponsored coverage.

- A change in marital status (getting married or divorced).

- Having a baby or adopting a child.

- Moving to a different area with new coverage options.

It’s important to enroll during the OEP to avoid a gap in coverage unless you qualify for a SEP.

Step 3: Create an Account on the ACA Marketplace:

To enroll in an ACA plan, visit Healthcare.gov or your state’s ACA marketplace website if it has its marketplace (such as California’s Covered California or New York State of Health). Here’s how you can get started:

- Create an account: You’ll need to provide basic personal information, such as your name, date of birth, Social Security number, and household income.

- Provide income details: Your household income will determine your eligibility for premium tax credits and cost-sharing reductions. The ACA marketplace uses this information to calculate your subsidy amount, which helps lower your monthly premiums and out-of-pocket costs.

- Verify your identity: The marketplace may ask you to verify your identity by providing documents such as your driver’s license or passport.

Once your account is created and verified, you’ll be able to browse available plans based on your location.

Step 4: Compare Plans and Costs:

The ACA marketplace offers a variety of health insurance plans categorized into four metal tiers: Bronze, Silver, Gold, and Platinum. These plans differ in terms of premiums, deductibles, and out-of-pocket costs. Here’s a breakdown of the tiers:

- Bronze: Lowest premiums, highest deductibles, and out-of-pocket costs. Good for healthy individuals who rarely need medical care.

- Silver: Moderate premiums and costs. If you qualify for cost-sharing reductions, you must choose a Silver plan to receive additional discounts.

- Gold: Higher premiums, but lower deductibles and out-of-pocket expenses. Ideal for individuals who expect frequent medical care.

- Platinum: Highest premiums, but lowest deductibles and out-of-pocket costs. Suitable for those who require extensive medical care.

When comparing plans, consider the following:

- Monthly Premiums: This is the amount you’ll pay every month to maintain coverage.

- Deductibles: The amount you must pay for healthcare services before your insurance starts covering costs.

- Out-of-Pocket Costs: This includes copayments, coinsurance, and the annual out-of-pocket maximum.

Use the marketplace’s comparison tool to weigh these factors and choose the plan that best fits your healthcare needs and budget.

Step 5: Apply For Subsidies and Discounts:

One of the primary benefits of enrolling in ACA health insurance is the availability of subsidies to make your coverage more affordable. There are two main types of financial assistance:

- Premium Tax Credits: These reduce your monthly premium costs and are available to individuals and families with incomes between 100% and 400% of the FPL. If your income qualifies, you can choose to apply these credits to your premiums throughout the year or claim them when you file your taxes.

- Cost-Sharing Reductions (CSRs): These help lower out-of-pocket costs, such as deductibles and copayments. CSRs are only available for those who choose Silver plans and have incomes between 100% and 250% of the FPL.

The marketplace will automatically calculate your eligibility for these subsidies based on the income information you provide. If you qualify, the savings will be applied directly to your chosen plan.

Step 6: Complete Enrollment and Pay Your First Premium:

Once you’ve selected a plan and applied for any subsidies, the final step is to complete your enrollment and pay your first premium. Keep in mind that your coverage won’t begin until you’ve made your first payment, so it’s crucial to pay on time.

After enrolling, you will receive an insurance card in the mail, which you can use to access healthcare services. Be sure to review your plan details, including the network of healthcare providers, to ensure that your preferred doctors and hospitals are included.

If your circumstances change during the year (such as a change in income or family size), you can update your information on the marketplace, which may adjust your subsidy amounts.

Open Enrollment Period Of Different States For 2025?

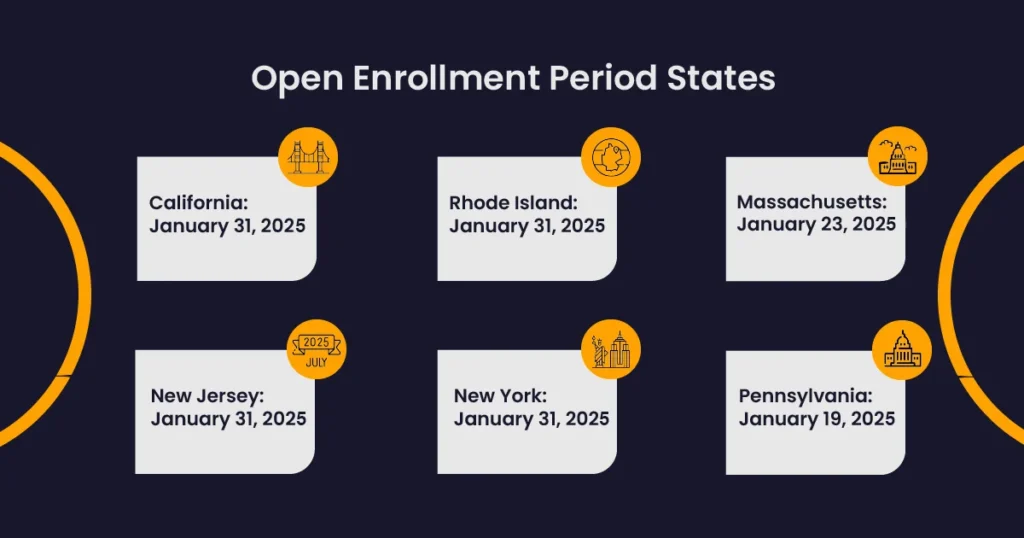

In most states, open enrollment for the 2024 coverage year ran from November 1, 2023, through January 16, 2024. However, the enrollment deadline depends on where you live in the U.S.

Some states have extended the open enrollment period. They are:

- California: January 31, 2025

- District of Columbia: January 31, 2025

- Massachusetts: January 23, 2025

- New Jersey: January 31, 2025

- New York: January 31, 2025

- Pennsylvania: January 19, 2025

- Rhode Island: January 31, 2025

Key Updates and Enhancements:

Alongside the open enrollment period coming up, CMS has been as active as possible in improving the consumer experience at HealthCare.gov and CuidoaDeSalud.gov. Since the formation of the healthcare.gov website, CMS has been evolving it consistently. This includes expanding the assistance the site offers to users as they apply and get enlisted in their coverage. The site keeps on being continuously visually optimized and this is done to facilitate the development of a more consistent look and style that follows the user throughout their journey. The process also ensures the communication of actions, notifications, and reminders.

Conclusion – How To Enroll in ACA Insurance During Open Enrollment:

Open Enrollment for health insurance may seem complex, but following these six steps will help guide you through the process. By understanding your eligibility, comparing plans, and applying for subsidies, you can secure affordable coverage that fits your healthcare needs. Be sure to take advantage of the open enrollment period or apply for a special enrollment if you experience a qualifying life event. With ACA coverage, you can protect yourself and your family from unexpected medical expenses while ensuring access to quality healthcare.

By following these steps, you can successfully enroll in ACA health insurance and gain access to quality, affordable healthcare coverage.