Choosing An ACA Plan With Preferred Doctors

Choosing the right ACA health insurance plan can be challenging, especially if you want to keep seeing your current doctors. Nearly 78% of Americans prioritize maintaining continuity with their healthcare providers when selecting a health plan, as familiar doctors play a significant role in managing ongoing care and health outcomes. Studies also show that patients who maintain consistency with the same doctor experience a 12-15% lower mortality rate.

This guide will help you find an ACA plan with preferred doctors, providing insights into network options, plan types, and cost considerations.

Read More: How To Choose Health Insurance For Young Adults | Complete Guide 2025

Key Takeaways:

- Verify In-Network Doctors: Confirm if your preferred doctors are in-network before selecting a plan. In-network status directly impacts both service access and cost.

- Understand Insurance Terms: Familiarize yourself with health insurance terms like “HMO,” “PPO,” and “POS” to understand coverage and network rules.

- Check Out-of-Network Policies: If a plan doesn’t include your doctor, evaluate the out-of-network costs involved to avoid unexpected expenses.

- Use Provider Verification Tools: Use your insurance provider’s online tools or customer service resources to check if your preferred doctors are covered.

- Evaluate Additional Benefits: Some ACA plans offer perks like telehealth, wellness programs, and discounts.

- Double-Check During Open Enrollment: Re-verify your doctors’ network participation during open enrollment to avoid coverage surprises.

Table of Contents

Importance of Networks:

Health plans under the ACA operate within specific provider networks—groups of hospitals, doctors, and specialists that have agreements with your insurance company. Staying within the network saves you money since insurers negotiate lower rates with in-network providers. Visiting an out-of-network doctor often means higher out-of-pocket costs; in fact, patients using out-of-network providers pay an average of 19% more than in-network services.

Understand Plan Types and Networks:

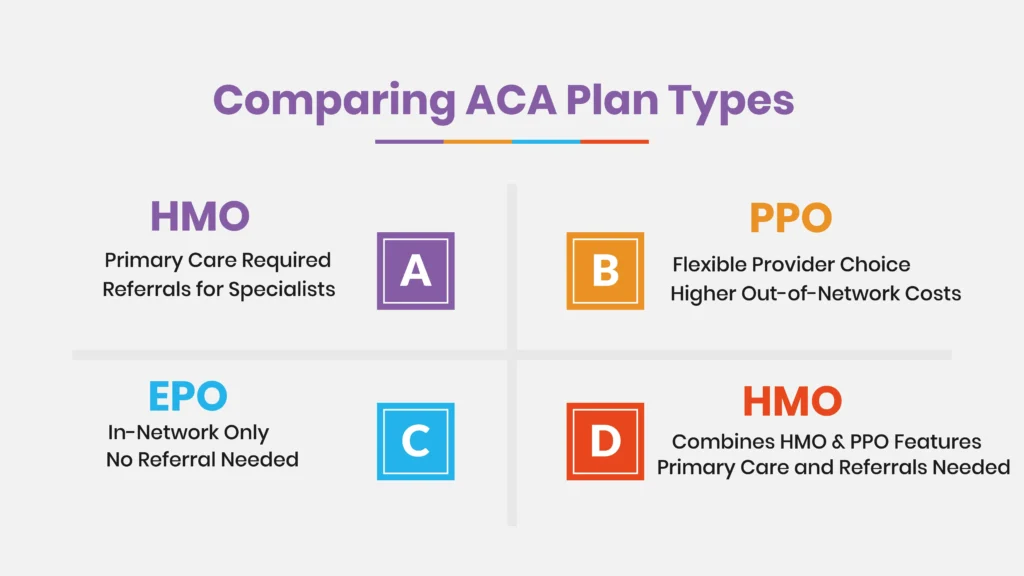

There are several types of ACA health plans, each with different network rules regarding doctor availability:

1. Health Maintenance Organization (HMO):

Typically, HMOs have stricter networks. You’re required to choose a primary care physician (PCP) and get referrals to see specialists. Your preferred doctors must be in the HMO’s network to be covered.

2. Preferred Provider Organization (PPO):

PPOs are more flexible, allowing you to see doctors in or out of the network. However, you’ll pay less if you stick to network providers. If your preferred doctor is out-of-network, a PPO might still be a viable option, though at a higher cost.

3. Exclusive Provider Organization (EPO):

Like an HMO, EPOs have a network of doctors and generally do not cover out-of-network care. However, you don’t need a referral to see a specialist. Ensure your doctors are within the EPO network to maximize coverage.

4. Point of Service (POS):

POS plans blend features of HMOs and PPOs. They often require a primary care physician and referrals for specialists, but you can see out-of-network doctors at a higher cost.

Check Provider Directories:

Once you have a plan type in mind, check the provider directories for each plan. Many insurance companies offer online directories where you can search for doctors by name, specialty, and location. Over half of consumers use these directories to verify if their preferred doctors are in-network. Ensure the directory is up-to-date by confirming your preferred doctor’s participation directly with their office, as provider networks can change frequently.

Understand In-Network and Out-of-Network Costs:

Seeing an in-network doctor usually saves you money, while seeing an out-of-network provider can lead to higher out-of-pocket costs. Health plans typically cover a smaller percentage of out-of-network charges, which means you’ll pay more.

For example:

- In-network visit: You might have a small copay or a percentage covered by insurance.

- Out-of-network visit: The insurance company may cover less, and you’ll be responsible for the balance, which can be significant.

To retain your preferred doctors affordably, aim for a plan where they are considered in-network providers.

Call Your Doctor’s Office for Verification:

While online directories are helpful, it’s best to call the doctor’s office directly. Ask if they accept the specific plan and whether they plan to continue doing so. Confirming this ensures that your coverage is secure and that you can rely on your current doctors for continued care.

Evaluate Out-of-Network Coverage Options:

If your preferred doctor isn’t in-network, you might still want to keep them. Some plans offer out-of-network coverage at a higher rate, which can be worth it for certain individuals. Compare the costs of out-of-network coverage against in-network options to see if the plan still works within your budget.

Check Additional Benefits and Consider Your Needs:

Some plans offer additional benefits, such as telemedicine services, wellness programs, or discounts on prescription drugs. When considering these perks, prioritize those that align with your healthcare needs. Sometimes, additional benefits can offset the cost of seeing out-of-network providers or provide alternative solutions, like online consultations with in-network providers.

Plan for the Long-Term:

Healthcare needs can change over time. Choosing a plan that includes your preferred doctors is important, but flexibility matters too. Assessing both current and future healthcare needs can help ensure you’re making a cost-effective, sustainable choice. A PPO, for example, may offer broader access in the long run, which could be worth a slightly higher premium if you need specialized care from different providers over time.

Use the ACA Marketplace’s Provider Lookup Tool:

Most ACA marketplace platforms offer tools that allow you to search for specific providers within each plan. Here’s how to make the most of it:

- Start Your Search Early: Researching options before open enrollment closes will give you enough time to consider and verify providers.

- Search by Your Provider’s Name: Input the name of your current doctor to see which ACA plans to include them. Be thorough; some doctors may be listed under different networks or locations.

- Check the Plan’s Provider Directory: Each insurance plan provides a directory of in-network providers, which you can download or search online. This list will be your best resource to confirm whether your preferred doctors are covered.

Check for Tiered Networks in Your ACA Plan:

Some ACA plans offer “tiered networks,” which assign providers to different cost-sharing tiers based on quality and cost factors. This structure can influence your out-of-pocket expenses, even within the network. If your preferred doctors are in a lower tier, you may face higher co-pays or deductibles to see them.

Consider Your Total Healthcare Costs:

When comparing ACA plans, look beyond the monthly premium. Consider deductibles, copayments, and coinsurance to estimate your total out-of-pocket expenses for in-network care. If your preferred doctors are in-network but you need frequent visits or treatments, a plan with a slightly higher premium but lower out-of-pocket costs might be worth it.

Explore Telehealth Options:

Many ACA plans offer telehealth services, allowing you to consult with in-network providers from the comfort of your home. This option can be especially valuable if your preferred doctor is geographically distant or if you have a busy schedule. Confirm whether telehealth services are available with your preferred providers and if they’re covered under your ACA plan.

Review Your Plan Annually:

Even if you find a plan that includes your preferred doctors, review your health insurance annually. Providers may enter or exit networks, and plans can change their coverage options or network rules each year. Staying informed about these changes ensures that your ACA plan continues to meet your needs without surprises.

Seek Professional Guidance:

If you’re having difficulty finding a plan with your preferred doctors or have specific medical needs, a licensed insurance agent can offer personalized advice. They can help you understand network details, and plan types, and find a plan that suits your healthcare needs and financial goals.

Conclusion – ACA Plan With Preferred Doctors:

Choosing an ACA plan that includes your preferred doctors requires attention to network types, provider directories, and plan specifics. By taking time to research, verify, and consider the total costs, you can find an ACA health plan that ensures you receive the care you need from the doctors you trust. According to recent studies, patients who maintain continuity with their doctors report a 15% improvement in health outcomes. Stay proactive and make informed choices to align your healthcare plan with your needs.

FAQ’s:

1. Why should I check if my doctor is in-network before choosing a plan?

In-network doctors and facilities have agreements with insurance providers to offer services at lower rates. Choosing a plan with your preferred doctors in-network can save you from paying higher out-of-network costs.

2. Can I add a doctor to my plan’s network?

Typically, patients can’t add doctors to a network, as these decisions are handled by the insurance company and healthcare provider. However, some providers may join networks over time, so it’s worth asking your doctor if they plan to join your insurer’s network.