ACA Medical Insurance | Key Features, Benefits, & Drawbacks In 2024

Want to know how to obtain ACA medical insurance?

Read this guide till the end to get answers to all your questions.

The signing of the Affordable Care Act (ACA, also referred to as Obamacare) in 2010 marked a turning point in American healthcare and introduced major changes in the sector. One of the key components of this plan to make health insurance more cost-effective was to allow insurance to be bought outside the workplace.

Primarily, the ACA enforces an insurance framework around medical insurance, which provides multiple benefits and protections to the people. In this comprehensive user guide, we will explore the main principles behind ACA medical insurance and analyze what it means to you and how it operates.

Table of Contents

What is ACA Medical Insurance?

Another type of insurance permitted under the Affordable Care Act is ACA medical insurance. This is popularly known as Obamacare. The ACA is an enormous reform law that has set forth a comprehensive set of healthcare reform policies and was enacted on March 23, 2010. The aforementioned categories of insurance must meet certain set standards, among which are the level of coverage, affordability, and consumer protections established by the Affordable Care Act.

Such plans have basic coverage, that is, such benefits as wellness care, emergency works, drug prescription coverage, and mental health and addiction treatment. Moreover, these plans are not allowed to charge higher premiums or discriminate against people already with some conditions as it is forbidden to them. The ACA medical health insurance is either accessed through an insurance plan purchased in the Health Insurance Marketplace or it is purchased from a health insurance company itself. People and their families will find different levels of coverance and these include bronze silver gold and platinum on the individual’s healthcare needs and budget.

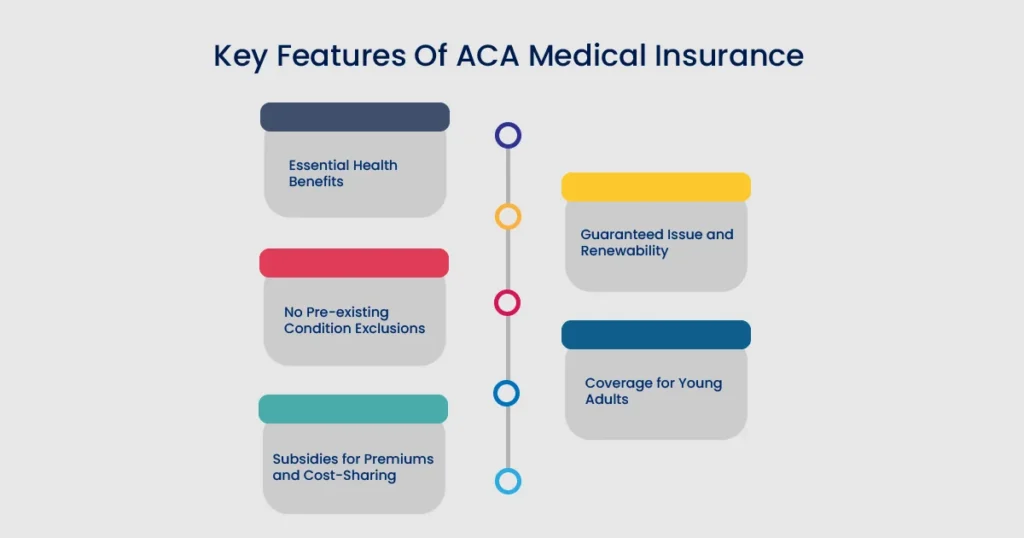

Key Features Of ACA Medical Insurance:

1. Essential Health Benefits:

The ACA standards mandate that any qualified health insurance plan should include a list of mandatory health benefits that include preventive care services, prescription drug coverage, pregnancy-related health checkups mental health systems operations, and so forth. Having complete insurance coverage in health care implies that people have all their needs covered at once.

2. No Pre-existing Condition Exclusions:

Perhaps the biggest change that the ACA made was to prohibit companies offering health insurance from being covered and being unable to build up that cost because of pre-existing conditions. This is one of the measures, that guarantees those suffering from health disabilities have access to insurance without them going through discrimination.

3. Subsidies For Premiums and Cost-Sharing:

With ACA, subsidies are given to individuals and the family with low incomes which are to make the insurance premiums and copays affordable. These disbursements allowed for healthcare coverage access to a greater amount of people based on income and the number of people in families.

4. Guaranteed Issue and Renewability:

ACA-compliant plans provide guarantee issues; thus, insurance providers are prevented from rejecting any individual who enrolls to be covered during the open enrollment period. The renewal aspect of these policies guarantees that the individual consumers have constant access to their insurance.

5. Coverage for Young Adults:

Under the ACA a young adult cannot be taken out of his parents’ insurance coverage before they are 26 years old. Young adults get additional years of coverage during a period that is marked as a transition in their lives.

How Does the Affordable Care Act Make Health Insurance Cheaper?

The matter of an application for a premium subsidy from the federal government enables affordable health insurance purchase through the use of the health insurance marketplace. Strictly charging premium tax credits against those who qualify and require submitting Form 8962 with their income tax reports.

Requirements to qualify for premium tax credits can include:

- Low household income or unemployment.

- Tax filing status other than Married Filing Separately.

- Be a victim of certain domestic abuse and spousal abandonment.

- Not claimed as a dependent by another person.

- Unable to get health insurance coverage via an employer-sponsored plan.

- Not eligible for coverage through a federal program, such as Medicaid, Medicare, or TRICARE.

What Are The Types of ACA Health Insurance Plans?

There are four different “mental levels” of health insurance plans under the Affordable Care Act:

- Bronze

- Silver

- Gold

- Platinum

Each metal tier has different costs. Your exact costs vary by insurance company, where you live, and other personal factors, such as your age.

Bronze and Silver plans have the lowest premiums, but the highest copayments and coinsurance amounts. Gold and Platinum will pay more insurance premiums when compared then Silver and Bronze but you will pay less when you require any health care services.

98% of the Plans belong to Bronze and Silver while the Platinum plans are much less.

How To Obtain ACA Medical Insurance:

- Health Insurance Marketplace: The Health Insurance Marketplace is an online space, where individuals and families can browse for healthcare insurance policies that have been modified to comply with the ACA. By way of the Marketplace, people find a plan and learn about subsidies that can be claimed by them and also see the open enrollment period.

- Medicaid Expansion: The ACA introduced Medicaid expansion in accommodating states thus giving the poor and lower-income families who meet particular conditions coverage. Unlike other states, eligibility criteria for Medicaid programs differ for each state, hence, keep your state Medicaid program among your priorities.

- Employer-Sponsored Insurance: Some business owners may also provide ACA-compliant health insurance programs. If you are eligible for employer-paid coverage (employers’ plans), you have to sign up for these plans in the enrollment period defined by your employer’s policies.

Pros and Cons:

Pros Of ACA Medical Insurance:

- More health situations being responded to by the health facilities could be witnessed.

- Makes insurers take responsibility for raises in the rates that are unjustifiable.

- In other words, the prior condition of somebody can’t count as a ground for rejection.

- Include additional screenings, immunizations plus preventive care as part of the health insurance coverage.

Cons Of ACA Medical Insurance:

- The deductibles and co-pays of the current insured went up throughout the process.

- The fees for the ACA were introduced to fund what it cannot do with taxing on medical device sales and pharmaceutical sales.

- The enrollment period ends quickly for new individuals who want to join.

- Many businesses would reduce the number of employee hours to prevent providing insurance.

The Importance of ACA Medical Insurance:

It cannot be denied that such a situation, where a person’s access to high-quality healthcare may determine whether their life is saved or not, underlines the importance of having comprehensive medical insurance coverage on top of any other healthcare system. The law ACA which came into force in 2010 has proved to be a transformative momentum to the extension of health coverage and better health outcomes for the wellbeing of American people. Let’s explore why having ACA medical insurance is paramount:

1. Protection Against Unforeseen Medical Expenses:

The number one reason most people would like their ACA medical insurance is the fact that it insures them against any financial losses that could arise due to an unexpected medical expense. Health insurance stands as the only financial safety net against a catastrophic medical emergency or chronic illness. It ensures that a single medical disaster or a long-term illness does not lead to the accumulation of prohibitively high medical bills and personal bankruptcy. The ACA insurance protects customers so that they no longer worry about healthcare bills which can make them bankrupt.

2. Access To Preventive Care:

ACA plans of health insurance emphasize your health protection by insuring you with no out-of-pocket cost for preventive care services such as screenings, vaccinations, and wellness visits. Finding health problems early has a tremendous benefit in keeping them under control or preventing them in the first place. This is one of the missions of preventive care. ACA including medical insurance, through being an approach to access prevention is essentially an avenue that keeps individuals healthy and in turn, reduces the need for expensive treatments later.

3. Coverage For Pre-existing Conditions:

Before the ACA, people had to try very hard to purchase adequate health insurance, if they had a pre-existing medical condition. As dictated by ACA, it is forbidden for insurance companies to turn down the coverage or to make the premiums higher if the prospective client has a pre-existing condition or a case history. The sole purpose is that those who have chronic illnesses or a previous sickness can access the vital support services they need without being looked down upon or being financially excluded.

4. Mental Health and Substance Abuse Treatment:

Mental health issues and substance use disorders are key issues that require the community to address with comprehensive holistic services. The ACA mandates coverage of mental health and substance abuse treatment services, doing for millions of people who otherwise might not have had access to such essential behavioral healthcare. This would be done to make sure that mental health is no longer taboo, to stir up the notion of early intervention, and to offer assistance to those who are battling alcohol or drug addiction or mental disorders.

5. Medicaid Expansion:

Under the ACA, the Medicaid eligibility limit was extended to millions of low-income people in the states that accepted the policy, thus effectively filling a large gap in healthcare coverage for underserved population groups. Medicaid enactment is the biggest health program that helps to lower the uninsured and increase access to care, and health equity among economically insecure individuals and families.

6. Financial Assistance For Lower-Income Individuals:

The ACA gives premium subsidies and cost-sharing reductions to give people from families and households with low incomes access to health insurance through the Health Insurance Marketplace. These subsidies allow healthcare to be more affordable and accessible for people who could have trouble paying for their healthcare package, and thus no person would be left behind because of the lack of resources.

7. Peace of Mind and Security:

It is possible then that the ACA medical insurance is the one which performs the most crucial role because this service serves not only people and their families but also gives them security and peace of mind knowing that they surely have the means to get the healthcare they need when they need it. It might be an appointment to see the doctor for regular checkups, family planning, or emergency health problems, the coverage of ACA health insurance brings stabilization and support in a world full of uncertainties.

Conclusion:

The Affordable Care Act (ACA) has transformed the healthcare landscape in the United States by providing access to affordable and comprehensive medical insurance to millions of Americans. ACA-compliant plans offer a range of benefits and consumer protections designed to improve the quality of healthcare and reduce costs for patients. These plans provide coverage for essential health services, including preventive care, prescription drugs, and hospitalization, among others. In addition, the ACA mandates that insurance companies cannot deny coverage to individuals with pre-existing conditions or charge them more for their insurance. Financial assistance is also available to individuals who meet certain income requirements, making healthcare coverage more accessible and affordable.

Whether you obtain coverage through the Health Insurance Marketplace, Medicaid expansion, or employer-sponsored insurance, understanding the features and benefits of ACA-compliant plans is crucial for making informed decisions about your healthcare coverage.

FREQUENTLY ASKED QUESTIONS:

Q: How much will I pay each month for the HealthSelect Medical plan?

If you are a qualified employee under the Affordable Care Act (ACA) and work an average of 30 or more hours per week, you will be eligible for the HealthSelect of Texas medical premium coverage without any personal cost. However, if you choose to cover eligible dependents, you will be required to pay a portion of the dependent premiums.

2. Will I be able to see the same doctor if I purchase coverage through the Marketplace?

Maybe. Insurance purchased through the Marketplace may have different provider networks than the HealthSelect plan.

3. Will I be eligible for a subsidy if I purchase medical coverage through the Marketplace?

Those without access to qualified healthcare coverage through their employer may be eligible for government subsidies to help pay for health insurance premiums for plans purchased in the Marketplace based on their income level and number of dependents. Most UH System employees are not eligible for these subsidies and UHS does not subsidize medical insurance premiums except through HealthSelect of Texas.